is refining gold profitable

Is Refining Gold Profitable?

The question of whether refining gold is profitable has become increasingly relevant as gold prices continue to fluctuate. For jewelers, miners, and investors alike, understanding the economics behind gold refining can help determine if it’s a viable venture. This article will explore the profitability of refining gold, the factors that influence it, and considerations for anyone thinking about entering this field.

Understanding Gold Refining

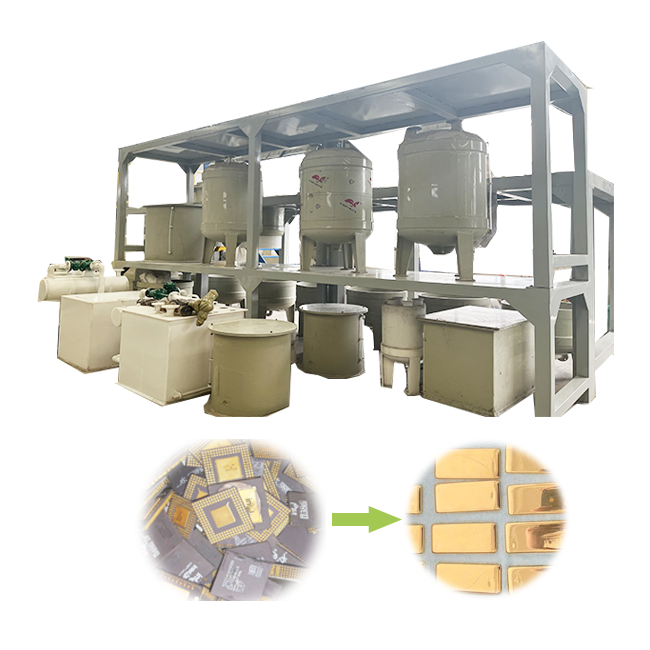

Gold refining is the process of purifying gold extracted from ores or scrap materials. The goal is to achieve a high level of purity, often 99.9% or higher, which increases the metal’s market value. Refining can be performed through various methods, including chemical processes and electrolytic refining. While the technical aspects are important, profitability often hinges on broader economic factors.

Factors Influencing Profitability

Market Prices

One of the primary determinants of profitability in gold refining is the current market price of gold. When gold prices are high, the margins for refining can be significant. Conversely, during periods of low prices, the potential profit can diminish. Keeping an eye on gold market trends is essential for anyone involved in refining.

Source Material

The type of gold being refined also affects profitability. Scrap gold from jewelry or industrial sources typically has lower purity levels, which may require more intensive refining processes. On the other hand, high-quality ores from mining operations can yield higher quantities of pure gold, making them more profitable to refine.

Refining Costs

The costs associated with refining are crucial to determining overall profitability. These costs can include:

- Chemical Supplies: The use of acids and other chemicals in refining can be expensive, impacting profit margins.

- Labor: Skilled labor is often required for effective refining, which adds to operational costs.

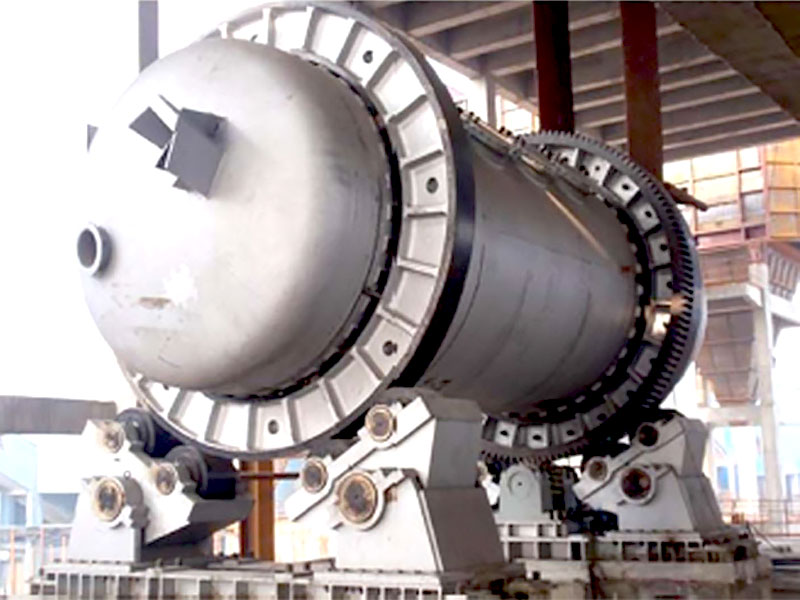

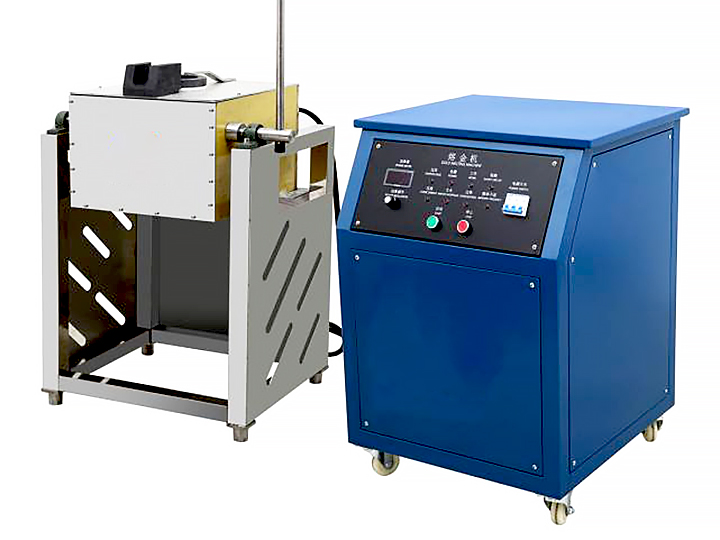

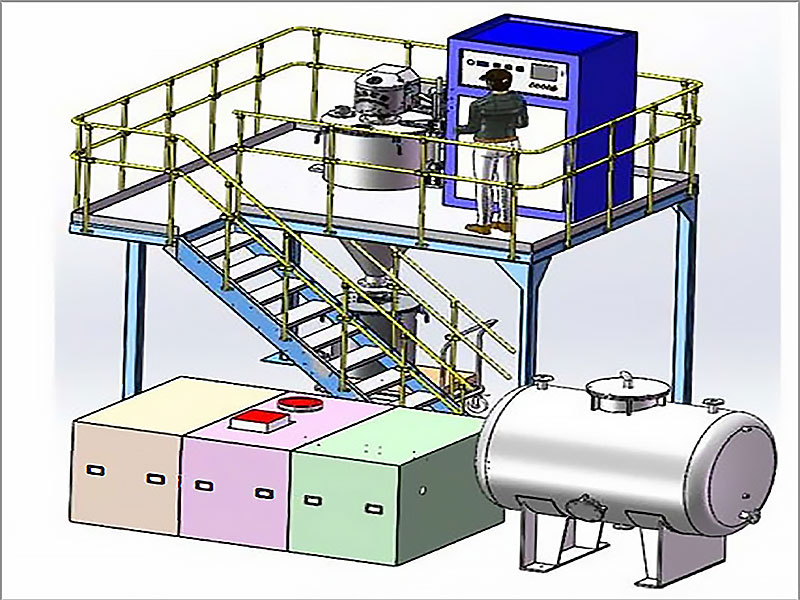

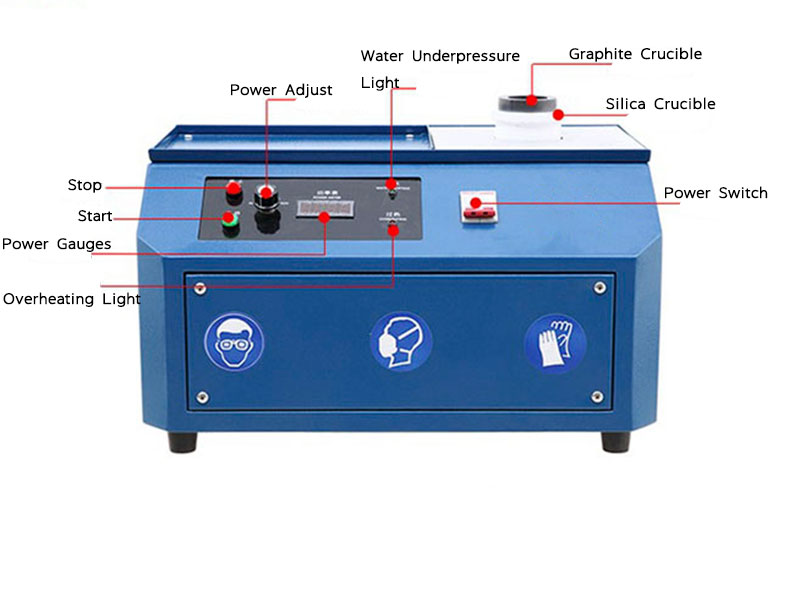

- Equipment: The initial investment in refining equipment, such as furnaces and electrolytic cells, can be substantial.

Understanding and managing these costs is key to ensuring that the refining operation remains profitable.

The Profitability of Scrap Gold Refining

For many jewelers and small-scale refiners, processing scrap gold is a common practice. The profitability of refining scrap gold often depends on:

- Quantity and Quality: Higher volumes of scrap gold can lead to better profitability due to economies of scale. Additionally, the quality of the scrap influences how much refining is needed and, consequently, the associated costs.

- Market Demand: The demand for refined gold in various industries can also impact profitability. When demand rises, refiners can charge higher premiums for their services.

Long-Term Considerations

Entering the gold refining business can be lucrative, but it’s essential to consider long-term factors that may affect profitability:

- Regulatory Compliance: Gold refining is subject to various regulations, including environmental laws. Compliance can incur additional costs but is necessary to operate legally.

- Sustainability Practices: As sustainability becomes increasingly important, refiners may need to invest in eco-friendly practices. While this can be costly initially, it may enhance profitability in the long run by appealing to environmentally conscious consumers.

Refining gold can be a profitable venture, particularly when market conditions are favorable and costs are effectively managed. Factors such as the source material, market prices, and refining costs play critical roles in determining profitability. For those considering entering the gold refining industry, understanding these elements is crucial to making informed decisions. By staying updated on market trends and implementing efficient practices, refiners can maximize their profit potential in this dynamic field.